Financing consulting with wow effect

Blog

12/17/2020

When using Finstar Notes and Finstar FinancingSuite, data is processed completely digitally throughout the entire loan transaction process. Finstar FinancingSuite serves as a web-based application for the bank advisor or consultant. They can use the app on their personal computer to prepare and follow up on customer meetings. The customer does not see it. On the other hand, Finstar Notes is a tablet app that the bank advisor can use and demonstrate live in front of his or her clients during client meetings.

Different work modes in Finstar Notes support the advisor in every point of the conversation with the customer. The consultant can write by hand on the tablet computer using the pen. Integrated handwriting recognition automatically converts the handwriting into digital data, which can be used to display simulations and visualizations of the loan process. Finstar Notes is adaptive enough to align different areas of the screen for different reading directions. While the advisor enters loan-to-value and affordability data, the customer on the opposite side of the table can simultaneously study the corresponding graphics.

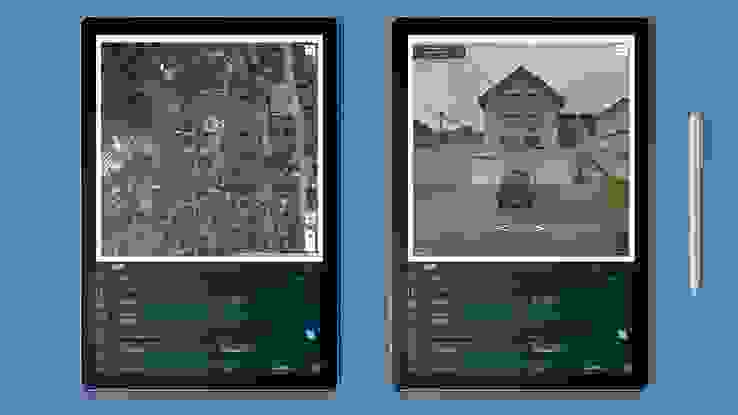

The wow effect is provided by a feature that allows the customer advisor to display a financing object in its real surroundings in Google Maps with a single click - Street View included. Documents and images of a financing object can also be easily uploaded to the app, giving the customer an overall profile. The system also reports if important information is missing or process requirements are not met. This ensures end-to-end process and advisory quality.

Street View included

Financing objects can be displayed in Google Maps with one click - Street View included.

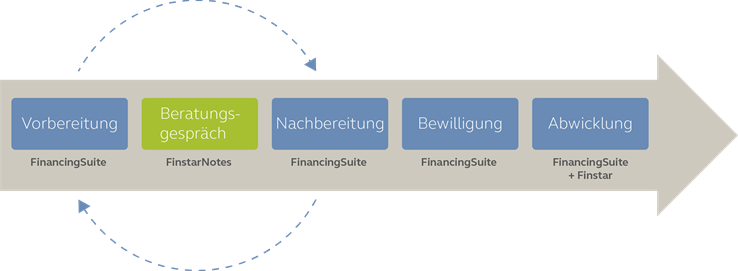

At the end of the meeting, the customer receives a complete personal financing proposal with all the details discussed. This can be sent by e-mail or handed out in printed form. And at the same time, the newly collected data from Finstar Notes is reconciled with Finstar FinancingSuite at the end of the consultation to facilitate post-processing by the advisor as well as further processing by the bank's approval and processing departments (see graphic). Thus, Finstar Notes and Finstar FinancingSuite cover the entire customer journey from start to finish. They contribute to more efficient data management within the bank, reduce media discontinuity and enable complete digitalization of internal processes.

Despite these facilitations, however, the personality of a consultant remains crucial to a successful deal. The professional knows this all too well. "A definitive deal cannot be generated through the use of the new consulting apps alone. The advisor's competence and empathy are also crucial. However, FinancingSuite and Finstar Notes help me achieve my goals better and increase my efficiency at the same time," says Daniel Sandmeier. Above all, he says, fewer repetitive questions arise with the new method. As a result, he can use the time gained through increased efficiency for other business.

Finstar Notes and Finstar FinancingSuite were developed by the Finstar department of Hypothekarbank Lenzburg. The banks in the Finstar network are offered the use of both applications as a fee-based service. However, it is also available to banks that do not use Finstar as a banking system. Finstar Notes and Finstar FinancingSuite are equipped with open interfaces that allow rapid integration into other banking systems.

Digital companion of the customer journey

Finstar Notes and Finstar FinancingSuite cover the customer journey from start to finish and contribute to more efficient data management within the bank.

We are happy to advise you +41 62 885 11 11

Finstar

c/o Hypothekarbank Lenzburg AG

Bahnhofstrasse 2

CH-5600 Lenzburg