«Assistant instead of app in the future?»

Magazine

4/21/2020

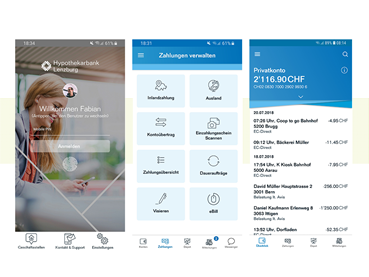

Having launched mobile banking and e-banking, Hypothekarbank Lenzburg lets its customers choose the channel. According to Massimo Catrambone, Technology & Development Partner Manager at Finstar, digital and analog platforms will continue to supplement each other in the future, and the way in which they will do so is yet to be determined.

Mr. Catrambone, when did Hypothekarbank Lenzburg’s mobile banking and e-banking go live?

Hypothekarbank Lenzburg customers have been able to use e-banking since summer 2018 and mobile banking since fall 2018. Both channels were developed in parallel. (Editorial note: At ‘Hypi’ Lenzburg, e-banking refers to online banking via desktop devices, while mobile banking refers to the use of mobile devices such as smartphones or tablets). Mobile banking took us a little longer though, because it was new to us. With regard to e-banking, we draw a distinction between two phases: The introduction of new functionality was followed by optimization of usability. The work is now mostly finished and we are focusing on further development, while taking feedback and users’ wishes into account.

What role, if any, do the analog channels still play?

On the one hand, we still give our customers the option of maintaining personal contact, especially when it comes to the individual consultation. On the other, the customer can do as much as they want via the electronic channels. That is up to them, and they can switch between analog and digital as they see fit. I see e-banking and mobile banking as the bank’s most important branches. We must invest accordingly: It is increasingly the case that every visitor to a real branch office is also a user of the virtual branches.

How is the use of the electronic branches developing?

Today, around 30 percent of customers use our e-banking. Of these, about one in five also uses mobile banking, but the numbers are growing fast in both categories. Users of mobile banking can be characterized as follows: Largely male, between thirty and fifty. Account balance queries, as well as the scanning and approval of payments with e-billing, are at the top of their list of requirements.

How many Finstar banks use mobile banking and e-banking?

Eight Finstar customers use e-banking and four of them use mobile banking. Retail banks and private banks are among them.

And how have users reacted?

While e-banking had a few teething problems, mobile banking was a huge success from the outset. User feedback has been very positive. If any issues

or questions arise, we can be contacted and we seek a solution.

Customized off-the-shelf product

How did you evaluate the solution?

Rather than a ready-made product, we looked for a development partner, so that we could help shape the product. With the Portuguese firm ebankIT, we were able to define what our solution contains and how it looks on the basis of a proven e-banking platform. This approach minimizes the time required for development and the costs for the banks. In addition, the solution can be adapted to the changing requirements of banks and their customers. In this

way, we also safeguard our independence in the long term.

How can a Finstar bank adapt its digital presence?

It can define which functionalities are activated, formulate text elements and decide on elements of the corporate identity. In the future, Finstar banks will specify the structure of the home page and how widgets are used. Thus, a customized platform can be realized, even though this is an off-the-shelf product. At the moment, though, we are not considering solutions that can be completely personalized. Otherwise, we would run the risk of the end customer

no longer being able to find key functions. We will continue to invest heavily in usability, so that the customer can orient themselves better and better.

What additional digital services can users look

forward to?

We are integrating a messenger as another interesting form of communication between customer and bank. We are introducing an application for foreign payments, QR billing, transaction signatures and other selected features. Areas that development work is focusing on include opening additional accounts,

taking out or extending mortgages, and managing debit and credit cards. In parallel, investment in security is continuing and we have ideas on how we can make our e-banking even more efficient. Last but not least, on the Finstar level, we are looking into how we can offer selected services to banks

via our shared platform.

What about topics like cryptocurrencies and

artificial intelligence?

The bank SEBA has already become the first crypto-bank in the Finstar community. We are watching and influencing developments in the cryptocurrencies domain – especially when it comes to mobile applications. In the context of artificial intelligence, we are assessing the use of bots, because recurring general queries can be answered in an automated way, around the clock. Our open interfaces, our ecosystem, and ideas and innovations from external sources play a key role in the use of many such technologies.

Suppose I have a good idea. How do I approach

Finstar?

First, we evaluate the benefits for our customers. Feasibility and the cost of development also play a role. If we are convinced, we prepare initial prototypes

and develop these further as a team, with usability experts and technical staff. We also make it possible for fintech firms to implement their ideas with our open banking platform. To this end, we provide a sandbox for trying things out. Here, regulatory and technological guidelines apply, as well as the bank’s internal guidelines. We are thus able to observe the development work, to support the

fintech firms, and to assess relevance with regard to us and our customers.

“Accolades included”

’Hypi’ Lenzburg is one of Switzerland’s most digital banks. How important are mobile banking and e-banking to the bank’s reputation?

The medium is the message. Without modern digital channels, firms cannot claim to be forwardlooking. For banks, simply having e-banking will be insufficient. In the future, the most digital bank will maintain open interfaces, because the customer will not just want e-banking, but also other cool fintech firms’ apps, which they can combine with the ‘Hypi’ banking app. We make that possible with our open banking APIs.

Do Finstar and ‘Hypi’ Lenzburg attach much importance to such titles?

What matters most to us is customer satisfaction. That is more important than any title. However, if you do something well, accolades are often included. They are the result and not the goal. Furthermore, they are merely snapshots. If we are to be the most digital bank, we must keep reinventing ourselves and continue to work in a focused manner.

What has (and is) development work focused on in

this respect?

For the customer, it has to keep getting faster and simpler. If the customer sees that digital channels are quick, easy, transparent and reliable, then they will stay with mobile banking, with e-banking, and with the bank that offers them these services together with a personal consultation.

How has Finstar addressed user experience and

usability?

We have collaborated intensively on these key aspects with the University of Applied Sciences and Arts Northwestern Switzerland. We jointly developed a design that outlines interactions and develops prototypes. The results were validated with diverse user groups. We visited business customers to see how they work and we arranged incorporation of these findings into product development.

For acceptance of digital solutions, security is key. How do you deal with this issue?

Our two-factor authentication with two isolated apps gives our solution an advantage. It makes things a little more complex at first, because two apps have to be set up, but it provides greater security.

What are you particularly proud of, personally?

In my view, the mobile banking has turned out really well. Not because of the quantity, but the quality of the functions. Also because of the ease with which banking transactions can be conducted.

And what does the future hold for digital channels?

Maybe there will no longer be any need for mobile banking because we will all conduct banking transactions with the aid of a virtual assistant. Whether it is voice-controlled or gesture-controlled doesn’t matter at all, the only prerequisite is a platform as an enabler. Consequently, we need APIs with which we can seamlessly combine any number of front ends and apps to form a large whole. Maybe mobiles will no longer be needed, but in order for our customers to be able to conduct their banking transactions easily and reliably, a bank with a modern IT platform and interfaces will be essential. Therefore, despite contrary expert opinions, there will be a need for banks, as long as these adapt to technological progress and customer requirements. How often have people made inaccurate predictions as a result of not being open to a different future?

Please send your questions on e-banking and mobile banking to:

massiom.catrambone@hbl.ch